Exploring the Different Types of Orders in the Forex Market

Before you enter the Forex market, you have to know about the different types of orders in Forex. In Forex, order means the way how you will choose to enter or exit the Forex market. There are different types of orders which exist in Forex and different brokers accept different orders.

Now, we will give you a brief idea about the different types of orders used in the retail trading industry. If you want to become a full-time trader, you must have a strong idea about these, or else you will not be able to execute high-quality trades in the market.

Market Order

It is the simplest type of order in Forex. It is also the most profitable type of order. It is the order which means; you can buy or sell your currency at the best available price. This order lets you make money in Forex at your best available price.

Stop-Entry Order

Stop–Entry order is that type of order when you set a limit for your trade to close automatically and make money. It is an automatic decision about an order. For example, you are trading GBP/USD at 1.2320 and you believe it will reach 1.2330. You can make a Stop-Entry order. That is, the trade will automatically close when the trade reaches 1.2330 and make you profit.

Stop-Loss Order

This is the opposite of the Stop-Entry order. You set it to limit your loss. In the example that we have given, you can set a Stop-Loss order at 1.2310 if you think the trade will go down. If the trade goes down to 1.2300, your trade will automatically stop at your set Stop-Loss price of 1.2310 and keep your account from running out of money!

Limit Entry Order

This type of order is a combination of the Stop-Entry order and Stop-Loss order. If you believe the market will hit at a point, you can use the Limit Entry order to buy below the market or sell above the market. When the market reaches that point, your trade will automatically close.

Those who are trading government bonds for a long time, often use the limit entry order as it helps them to reduce the hassle in trading. While using such an order, make sure you keep the risk factor low since you can never predict the outcome from a given trade.

Trailing Stop

This type of order is similar in pattern to the Stop-Loss order. These orders are placed to make a minimum loss. The unique feature of this order is that, if you set the limit to 20, as long as the market moves, it will always go up keeping a distance of 20 and making your profit as large as it can be. But if the market trading is going down, it will remain constant to your set position and stop at the point you set to minimize the risk.

Some other types of order

Apart from these popular and most used orders, there are some other types of orders.

Good for the Day (GFD)

The order is active until the market closes

One-Triggers-the-Other

This is a mixture of two Stop-Loss orders. If one of the orders is activated, the other trade is also triggered.

One-Cancels-the-Other

Like the one-triggers-the-other order, this order is also a mixture of two Stop-Loss orders. If you place two orders, when one order is triggered, the other order gets cancelled. It is the opposite of one triggering the other order.

Good ‘Till Cancelled

This type of order is active until you close the order. It is an order that is in your hands, and that you can choose to cancel.

Summary

These are the most popular types of orders in Forex. Some of the other orders are used, but the popular orders are mostly commonly used in Forex trading. With the right choice of order, you can make money in the Forex market.

Similar Articles

Are you ready to buy your first Bitcoin? Bitcoin is a solid investment these days and perhaps everyone knows it by now! There are thousands of cryptocurrencies in the market today but bitcoin is the first and largest one. However, it's important to keep your investment safe.

When it comes to getting filthy rich overnight, folks usually find the key to success to be investing in stock markets. The good news is that today in the era of tremendous technological advancement investing in stocks is now possible with one and only one condition:

The forex market provides traders with some lucrative money making opportunities. However, not all traders end up rich. In fact, statistics indicate that most traders lose money and close their accounts within 3-6 months of joining the forex market. This could be partly because they jumped in without considering the potential implications of some aspects of forex trading, like the FX spread.

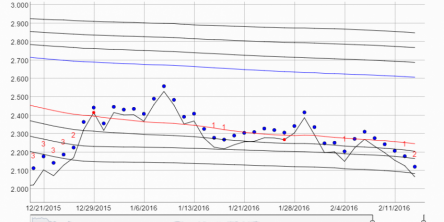

With the threat of volatility always looming in the energy markets it is imperative on the part of natural gas, WTI or Brent crude oil, diesel or gasoline traders to secure low-risk positions. They should be alert about the risks posed by the volatile energy markets and mitigate that risk in a timely manner so that they can lock in profits or minimize losses.

Foreign exchange market is quite a volatile market. Where the currencies vary a lot, a keen watch on the market is what will keep the trend going and allow the business to become fruitful and grow. If you are looking to invest in the foreign exchange business yourself you need to have an idea about the market

Any company that either produces or consumes large quantities of energy will most likely be interested in managing energy price risk. The energy markets are historically volatile, and these price fluctuations can have a huge impact on a company’s bottom-line.

Systems and strategies also offer wins in the market. If you want to change your strategy to reduce risk, then you will want to consider leading trade signals. These offer forward – thinking tools that allow you to predict the changes in the market.

The strategy you use in the market determines the profit you get in return. However, the uncertainty and changes that take place can lead to a strategy that is ineffective. Boost your tactics by using leading market indicators.

In this write-up we discuss some of the benefits of energy forecasts and how they can help in mitigating risks and beating volatility.