Risk Management in Trading - Your Path to Success

Any company that either produces or consumes large quantities of energy will most likely be interested in managing energy price risk. The energy markets are historically volatile, and these price fluctuations can have a huge impact on a company’s bottom-line. Therefore, managing this risk in a sound, well-planned, and effective manner can be a key to success. However, it is important to have an energy risk management plan in place so that the program can meet your company’s risk appetite goals.

How to Manage Energy Price Risk Efficiently?

Energy risk management, or hedging, is not speculative trading. Although the actions and instruments are the same, the goals are much different. The goal of speculative trading is to make money by timing directional trades in the markets. The goal of hedging is to mitigate risk through the use of longer term positions that are slowly built over time so that the financial potion (hedge position) offsets the cost of the physical commodity (cash market price). On other words, a hedger goal is to stabilize the fluctuations in the price of the physical commodity that they are buying or selling.

To that end, hedgers must have a very disciplined and well thought out approach to placing hedges that will help them reach goals based upon their unique risk appetite. One of the most effective ways to efficiently achieve this is to work with an energy risk management consultant to help create a hedging strategy. This strategy should address all goals, situations, and risks involved so that once the plan is approved the hedger can execute hedges without spending costly time trying to make decisions.

Risk Management in Today’s World

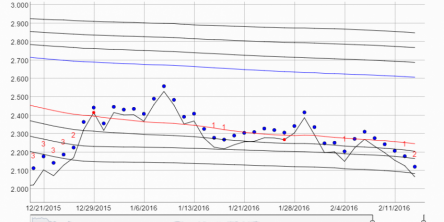

The advent of Internet marked a new beginning for energy hedging, especially for smaller companies that gained access to risk management tools to help them analyze the market, get a clearer picture of the trends, and execute hedges electronically. These tools and risk management systems offer comprehensive information about the market, precise data on trades, volumes and prices movements. Almost importantly, they provide hedgers with proven price risk management plans that are based on statistical models that account for historical data and market price cycles.

How Statistical Approach To Risk Management When Hedging Helps?

- Define your goal: One of the greatest advantages of using a risk management tool is the fact that can be adapted to help you achieve your risk management goals. Once you have set your eyes on a target you are in a better position to avert risk. You can also adjust the model and program over time as your risk management and hedging goals change.

- Balancing risks and rewards: As an energy producer, you receive the best prices for your physical commodity when prices are high. However, the opposite is true when prices fall to lows. However, with an effective risk management program in place, a producer can mitigate the risk of low prices by locking in using derivatives when prices are statistically high. The same is true for consumers, who would lock in using derivatives when prices are low.

- Decision models: These models help you make the right decisions and allow you to everage opportunities in the market. You can gain access to broad execution strategies that help you make the right decision at the most opportune time in terms of your hedges.

As an energy hedger a well thought out plan that fits your goals and risk appetite and the right statistical mdoels can help in your endeavor.

Summary

In this write-up we talk about risk management in energy hedging and why it is the right path towards success in a market that is governed by volatility.

Similar Articles

Before you enter the Forex market, you have to know about the different types of orders in Forex. In Forex, order means the way how you will choose to enter or exit the Forex market.

Are you ready to buy your first Bitcoin? Bitcoin is a solid investment these days and perhaps everyone knows it by now! There are thousands of cryptocurrencies in the market today but bitcoin is the first and largest one. However, it's important to keep your investment safe.

When it comes to getting filthy rich overnight, folks usually find the key to success to be investing in stock markets. The good news is that today in the era of tremendous technological advancement investing in stocks is now possible with one and only one condition:

The forex market provides traders with some lucrative money making opportunities. However, not all traders end up rich. In fact, statistics indicate that most traders lose money and close their accounts within 3-6 months of joining the forex market. This could be partly because they jumped in without considering the potential implications of some aspects of forex trading, like the FX spread.

With the threat of volatility always looming in the energy markets it is imperative on the part of natural gas, WTI or Brent crude oil, diesel or gasoline traders to secure low-risk positions. They should be alert about the risks posed by the volatile energy markets and mitigate that risk in a timely manner so that they can lock in profits or minimize losses.

Foreign exchange market is quite a volatile market. Where the currencies vary a lot, a keen watch on the market is what will keep the trend going and allow the business to become fruitful and grow. If you are looking to invest in the foreign exchange business yourself you need to have an idea about the market

Systems and strategies also offer wins in the market. If you want to change your strategy to reduce risk, then you will want to consider leading trade signals. These offer forward – thinking tools that allow you to predict the changes in the market.

The strategy you use in the market determines the profit you get in return. However, the uncertainty and changes that take place can lead to a strategy that is ineffective. Boost your tactics by using leading market indicators.

In this write-up we discuss some of the benefits of energy forecasts and how they can help in mitigating risks and beating volatility.